What Type Of Expense Is Cost Of Goods Sold . Web how to calculate the cost of goods sold (cogs) cogs and inventory; Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while. Web cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Choosing an accounting method for cogs; Sales revenue minus cost of goods sold. It includes material cost, direct labor cost, and. You should record the cost of goods. Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Cost of goods sold is the direct cost incurred in the production of any goods or services. This includes direct labor cost,. Web what is cost of goods sold (cogs)? Web cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or services. Web what type of account is cost of goods sold on an income statement?

from www.patriotsoftware.com

Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Web cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. It includes material cost, direct labor cost, and. Sales revenue minus cost of goods sold. Web what type of account is cost of goods sold on an income statement? Cost of goods sold is the direct cost incurred in the production of any goods or services. Web how to calculate the cost of goods sold (cogs) cogs and inventory; You should record the cost of goods. Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while. Web what is cost of goods sold (cogs)?

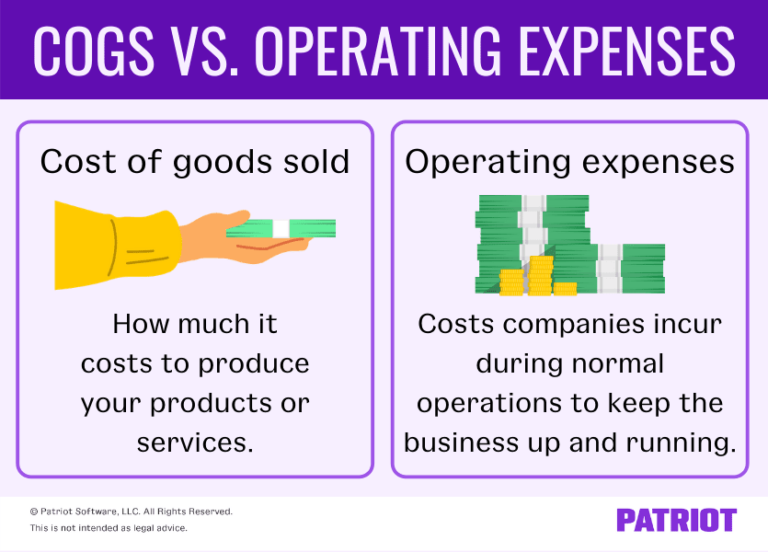

Cost of Goods Sold vs. Operating Expenses Complete Guide

What Type Of Expense Is Cost Of Goods Sold Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while. Web what is cost of goods sold (cogs)? Choosing an accounting method for cogs; Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while. It includes material cost, direct labor cost, and. Web cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Web cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or services. Sales revenue minus cost of goods sold. Web what type of account is cost of goods sold on an income statement? Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. You should record the cost of goods. Cost of goods sold is the direct cost incurred in the production of any goods or services. This includes direct labor cost,. Web how to calculate the cost of goods sold (cogs) cogs and inventory;

From www.chegg.com

Solved Cost of Goods Sold, Profit margin, and Net for What Type Of Expense Is Cost Of Goods Sold Cost of goods sold is the direct cost incurred in the production of any goods or services. It includes material cost, direct labor cost, and. Web cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or services. Web the cost of goods sold (cogs) is an accounting term used to describe the direct. What Type Of Expense Is Cost Of Goods Sold.

From www.chegg.com

Solved Compute cost of goods sold using the following What Type Of Expense Is Cost Of Goods Sold Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while. You should record the cost of goods. It includes material cost, direct labor cost, and. Web what type of account is cost of goods sold on an income statement? Cost of goods sold is the direct cost incurred. What Type Of Expense Is Cost Of Goods Sold.

From learn.financestrategists.com

Cost of Goods Sold (COGS) Formula, Examples, What Is Included What Type Of Expense Is Cost Of Goods Sold Web what is cost of goods sold (cogs)? It includes material cost, direct labor cost, and. This includes direct labor cost,. You should record the cost of goods. Web what type of account is cost of goods sold on an income statement? Web cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or. What Type Of Expense Is Cost Of Goods Sold.

From www.youtube.com

how to calculate cost of goods sold from statement YouTube What Type Of Expense Is Cost Of Goods Sold Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Web how to calculate the cost of goods sold (cogs) cogs and inventory; Sales revenue minus cost of goods sold. Web what type of account is cost of goods sold on an income statement? You should record the cost of goods.. What Type Of Expense Is Cost Of Goods Sold.

From shoppoin.blogspot.com

How Much Does It Cost To Lease A Shop Shop Poin What Type Of Expense Is Cost Of Goods Sold You should record the cost of goods. Sales revenue minus cost of goods sold. Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Web cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Web cost of. What Type Of Expense Is Cost Of Goods Sold.

From www.financestrategists.com

Cost of Goods Sold (COGS) Definition and Accounting Methods What Type Of Expense Is Cost Of Goods Sold You should record the cost of goods. Web cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Web how to calculate the cost of goods sold (cogs) cogs and inventory; Choosing an accounting method for cogs; Web the cost of goods sold (cogs) is an accounting. What Type Of Expense Is Cost Of Goods Sold.

From www.chegg.com

Solved STATEMENT Sales Cost of goods sold What Type Of Expense Is Cost Of Goods Sold Sales revenue minus cost of goods sold. You should record the cost of goods. Web how to calculate the cost of goods sold (cogs) cogs and inventory; Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while. Choosing an accounting method for cogs; Cost of goods sold is. What Type Of Expense Is Cost Of Goods Sold.

From www.wallstreetprep.com

Cost of Goods Sold vs. Operating Expenses What is the Difference? What Type Of Expense Is Cost Of Goods Sold Web what type of account is cost of goods sold on an income statement? Web what is cost of goods sold (cogs)? Choosing an accounting method for cogs; Sales revenue minus cost of goods sold. This includes direct labor cost,. Web cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or services. Web. What Type Of Expense Is Cost Of Goods Sold.

From www.bdc.ca

What is the cost of goods sold (COGS) BDC.ca What Type Of Expense Is Cost Of Goods Sold Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Choosing an accounting method for cogs; Web how to calculate the cost of goods sold (cogs) cogs and inventory; It includes material cost, direct labor cost, and. Web what is cost of goods sold (cogs)? Web what type of account is. What Type Of Expense Is Cost Of Goods Sold.

From www.chegg.com

Solved Cost of Goods Sold, Profit margin, and Net for What Type Of Expense Is Cost Of Goods Sold Choosing an accounting method for cogs; You should record the cost of goods. Cost of goods sold is the direct cost incurred in the production of any goods or services. This includes direct labor cost,. Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while. Web what is. What Type Of Expense Is Cost Of Goods Sold.

From www.homeworklib.com

Sales revenue Cost of goods sold Gross profit Selling and What Type Of Expense Is Cost Of Goods Sold You should record the cost of goods. Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while. Web how to calculate the cost of goods sold (cogs) cogs and inventory; Sales revenue minus cost of goods sold. Choosing an accounting method for cogs; Web what type of account. What Type Of Expense Is Cost Of Goods Sold.

From studenttube.info

Cost of Goods Sold Statement Basic Accounting What Type Of Expense Is Cost Of Goods Sold Sales revenue minus cost of goods sold. Cost of goods sold is the direct cost incurred in the production of any goods or services. You should record the cost of goods. Web cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. It includes material cost, direct. What Type Of Expense Is Cost Of Goods Sold.

From www.slideserve.com

PPT Chapter 7 PowerPoint Presentation, free download ID6421395 What Type Of Expense Is Cost Of Goods Sold It includes material cost, direct labor cost, and. Cost of goods sold is the direct cost incurred in the production of any goods or services. Web cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Web what is cost of goods sold (cogs)? Web cost of. What Type Of Expense Is Cost Of Goods Sold.

From www.accountancyknowledge.com

Cost of Goods Sold Examples CGS Format Solved Problems What Type Of Expense Is Cost Of Goods Sold Sales revenue minus cost of goods sold. Choosing an accounting method for cogs; Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. It includes material cost, direct labor cost, and. Web cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell. What Type Of Expense Is Cost Of Goods Sold.

From www.patriotsoftware.com

Cost of Goods Sold vs. Operating Expenses Complete Guide What Type Of Expense Is Cost Of Goods Sold Web cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Web how to calculate the cost of goods sold (cogs) cogs and inventory; Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. It includes material cost,. What Type Of Expense Is Cost Of Goods Sold.

From www.slcbookkeeping.com

The Real Difference Between Expenses and Cost of Goods Sold What Type Of Expense Is Cost Of Goods Sold You should record the cost of goods. Choosing an accounting method for cogs; Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while. This includes direct labor cost,. Web how to calculate the cost of goods sold (cogs) cogs and inventory; Sales revenue minus cost of goods sold.. What Type Of Expense Is Cost Of Goods Sold.

From haipernews.com

How To Calculate Cost Of Goods Sold Haiper What Type Of Expense Is Cost Of Goods Sold Web cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or services. Choosing an accounting method for cogs; Sales revenue minus cost of goods sold. Web how to calculate the cost of goods sold (cogs) cogs and inventory; Web the cost of goods sold (cogs) is an accounting term used to describe the. What Type Of Expense Is Cost Of Goods Sold.

From www.superfastcpa.com

Is Cost of Goods Sold an Expense? What Type Of Expense Is Cost Of Goods Sold Web what type of account is cost of goods sold on an income statement? You should record the cost of goods. Sales revenue minus cost of goods sold. It includes material cost, direct labor cost, and. Web what is cost of goods sold (cogs)? Cost of goods sold is the direct cost incurred in the production of any goods or. What Type Of Expense Is Cost Of Goods Sold.